Contribute

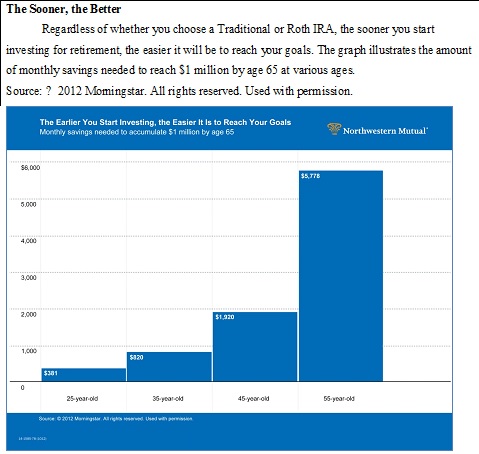

| What You Need To Know About IRAs |

Kanan Sachdeva, Northwestern Mutual

03/04/2014

To Convert or Not to Convert? With higher tax rates expected in the near future, converting all or part of a Traditional IRA to a Roth can provide significant income tax and estate tax savings over time, especially for high income taxpayers. However, there are many factors to consider prior to converting. To see if a Roth conversion is right for you, consult with your tax and investment professionals.

Investing for retirement is one of the most important things you can do for your future. Yet an employer-sponsored savings plan, such as a 401(k), may not be enough to provide the savings you need. For many, an Individual Retirement Account is one of the best ways to accumulate additional retirement savings on a tax-advantaged basis.

There are two main types of IRAs, Traditional and Roth. Both have the same contribution limits, the same catch-up provisions for people age 50 and older (for this year’s amount, go to the Internal Revenue Service website, www.irs.gov), and both allow your investment earnings to compound with taxes deferred until you start taking withdrawals, typically at retirement.

To help determine which IRA is right for you, it’s important to consider how they differ.

Eligibility

Almost anyone can contribute to a Traditional IRA, provided you (or your spouse, if you are married and file jointly) have earned income and you are under age 70 ½. However, if either you or your spouse is covered by a retirement plan at work, you may not be allowed to deduct all or part of your contributions. If you don’t have an employer-sponsored plan, you can deduct the full amount of your contributions, regardless of your income.

In contrast, Roth IRAs are subject to income limits, whether or not you’re covered by a retirement plan at work. This means not everyone can take advantage of one. Additionally, contributions are not tax deductible. On the plus side, Roth IRAs have no age restrictions; as long as you meet the income requirements, you can contribute to your account for as long as you like. (To learn more about your eligibility, consult the IRS website at www.irs.gov).

Tax Advantages

One of the biggest differences between Traditional and Roth IRAs is when you pay income taxes on the money you contribute. A Traditional IRA may provide up-front tax savings; with a Roth IRA, tax benefits come at the back end.

Contributions to a Traditional IRA may be tax deductible, subject to certain requirements. As a result, any contributions to your account may help lower your taxable income in the year in which you make them. But even if you can’t claim any tax breaks from your Traditional IRA, you still can make nondeductible contributions to your account.

With a Roth IRA, contributions are made with after-tax dollars, meaning the money you contribute has already been taxed, with no benefit of a deduction.

Taking Money from Your Account

The other big difference between the two types of IRAs is how distributions are received. When money is taken from a Roth IRA at retirement, it’s potentially tax-free — and that includes your tax-deferred earnings. That’s different from a Traditional IRA, which is fully taxable at current tax rates when withdrawn.

Taking money from a Roth IRA is also more flexible. Like Roth IRAs, Traditional IRAs typically impose distribution penalties for withdrawals taken before age 59 ½; they also require you to begin taking minimum required distributions at age 70 ½ — whether or not you need the money. If you fail to take your distribution, you’ll face stiff penalties.

In contrast, Roth IRA owners are not subject to required minimum distribution rules. Because you don’t have to take mandatory withdrawals at age 70 ½, a Roth IRA enables you to

extend the tax advantages of your account longer than with a Traditional IRA. And with a Roth IRA, you can also continue contributing to your account for as long as you like. That can be a great help, especially if you plan on working past traditional retirement age.

Which is Better?

One rule of thumb suggests that if you think your tax rate is higher today than it will be in retirement, a Traditional IRA may make better sense. Conversely, if your tax rate is lower than you think it will be when you start taking withdrawals, a Roth IRA may be the better choice, assuming you qualify for one.

What’s important to remember is that everyone’s situation is different. To help ensure you select the right IRA for your needs, be sure to consult with a financial representative or tax professional. He or she can help you carefully weigh all the factors and determine which option is most suitable for you.

You may also access this article through our web-site http://www.lokvani.com/