Archives

Contribute

|

|

Buyers Beware!!! - Part 2

|

|

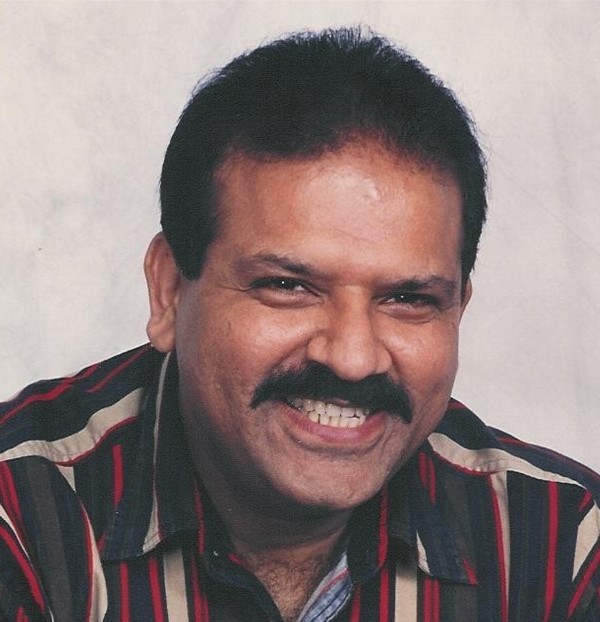

Praful Thakkar

04/20/2006

Buying a home is a major investment. A major

decision. At the end of this process, buyers are equity rich and cash poor. For

many buyers, they will be poorer because this has become more expensive process

than it needs to be. For many buyers, this is expensive because they fall prey

to few common and costly mistakes.

A decision that could turn into a costly mistake

- By paying too much for the home they want

- Or by losing their home to another buyer

- or worse, buying the home based on emotions and

find later that their needs are different than wants

In my last

article, we looked at some of the

common (and costly) mistakes like -

- Getting into bidding Frenzy

- Buying based on pure emotions

- Not getting mortgage pre-approval

- Unaware of Seller’s Disclosures

- Skip home inspection:

Here are some more common (and costly) mistakes

–

- Missing contract dates: You saw the home,

you liked it. You made an offer and offer was accepted – with some deadlines for

inspection, mortgage application, purchase and sales agreement and mortgage

commitment. But you are now happy and busy, too. You – your offer is accepted

and you’ll get the home – sooner or later. You arrange for inspection but radon

test results are delayed and you’ll have to sign the P&S agreement. What

should you do? It may be a better idea to plan everything in advance so that you

do not miss any contract dates or if you cannot avoid it, have an extension

signed to protect you.

- Unaware of closing costs: You saw the home,

you liked it. You made an offer and offer was accepted. When you are at a

closing table, more eager to get the key of your new home, you are simply

shocked when you look at the number you need to pay at the closing table! You

are not aware of escrow or any other costs associated with the transaction. What

should you do? You still have to pay the costs. The excitement of owning your

first home is now evaporated!!! You wish, if your agent had educated you about

these numbers….

- Avoid Attorney Review: You saw the home,

you liked it. You made an offer and offer was accepted. When you receive the

purchase and sale contract, you are little curious what it is. It’s a binding

contract between you and the seller. There are some ‘standard’ clauses in it and

some non-standard. Mostly, the original P&S is from the seller and protects

seller’s interest. You find nothing wrong in it, sign it and send it back to the

seller. Are you protected? What should you do? Skipping attorney review may save

you some money but is it worth an stress if things don’t work your way?

- Ignoring Red Flags: You saw the home, you

liked it. You thought, you can survive with the pealing paint and ugly wallpaper

because you plan to paint the home anyways. You may not use basement so little

sipping three years ago need not be an issue. You purchased the home but your

situation is changed. Your parents are visiting your new home so paint project

is delayed. What happened three years ago happened this spring, too! Lots of

rain!!! Now it is flooding in the basement!!! You will end up spending much more

money than you ever expected down the line. What should you do? You can always

use these red flags to bargain the price – if you can live with it. Don’t

nit-pick, though and if the price is right, decide based on the severity of the

red flags. But do not ignore these red flags in any circumstances.

- Waiting forever for your next home: You saw

the home, you liked it. You talked to your friends and they said – ‘Why don’t

you wait for some more time? This is buyers market. The seller will bring down

the price.’ Your friends are right – after 6 weeks, the price came down by

$10,000! You asked your friends again. They had the same suggestion. Again, they

were right. The price was down, this time, by $15,000 after another 6 weeks. Now

was the time to go for the home. As your friends suggested, now you make an

offer that is another $10,000 less than asking price. Well, you were little

short – someone else paid just $1,000 more than you and you lost the home!!! And

the cycle repeats for few more homes. Did you realize that interest rate has

jumped up by almost 15% - from 5% to 6%? What should you do? If you like the

home, do not wait too long. Chances are, someone will like that home, too. You

would lose the home and start all over again! In fact, of all the mistakes, in

my opinion, is the most costly mistake.

Are you one of them? Or are you likely to be one of

them?

An advanced approach to buying a home can help you

stay away from all these common and costly mistakes. You want to be an

‘ISB’ – an Internet Savvy Buyer – a buyer who would seek the

professional guidance and consult a professional for all your needs.

I am organizing a FIRST TIME HOME BUYERS SEMINAR on

Sunday, 30th April, 2006. For more information and registration,

click here.

|

|

You may also access this article through our web-site http://www.lokvani.com/

|

|