Contribute

| 3 Ways To Lower Medical Costs |

Jai M Dev

10/04/2018

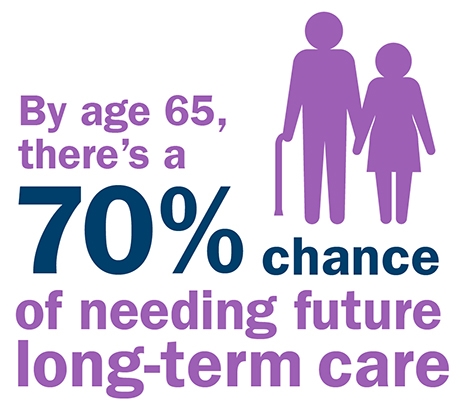

Concerned about unexpected health care costs? You’re not alone. More than 1 in 3 Americans cited the possibility of significant health problems as a top financial concern, according to a recent Ameriprise study.1 For some respondents, one way to tackle this concern is staying fit: Many cited “making positive health changes†as a top personal goal they’d like to achieve in the next five years. That said, medical problems can still happen to the healthiest people — that’s why prevention really is the best medicine when it comes to financial planning for health care costs. Here are three ways to help ensure unexpected medical expenses don’t get in the way of your long-term financial wellness. As early as possible in your earning career, consider opening a health saving account (HSA) to help pay for medical expenses. This savings tool is available to those enrolled in a high-deductible health plan (HDHP), and funds can accumulate year over year. Tax savings are one of the key benefits of an HSA. Contributions come out of pre-tax dollars, earnings grow tax-deferred and withdrawals for medical expenses are tax-free. Congress is working on legislation that would further expand the appeal of HSAs. Proposals address a broader range of qualified medical expenses, such as fitness programs and over-the-counter medications, as well as other modifications that could increase HSA accessibility and contribution levels. The 2018 annual HSA contribution limit is $3,450 ($6,900 for a family), with a catch-up allowance of $1,000 a year for those age 55 and older. These modest savings can really add up. After 10 years contributing the family maximum amount at an estimated 2% rate of return compounded monthly, you’d have close to $85,000 saved for health care expenses. Since HSA funds can benefit you by accumulating over time, you may want to consider balancing contributions and withdrawals, so funds are available for larger medical expenses that may occur in the future. What if you don’t need those savings for medical costs? One of the lesser-known advantages of an HSA is that at age 65, funds can be tapped to supplement your retirement income. Withdrawals will be taxed the same as an IRA, but you won’t pay a penalty for using them for non-medical expenses in retirement. While HSAs behave like IRAs in some ways, they aren’t subject to the same level of scrutiny by regulators. Make sure to inquire about fees and risks associated with these accounts. Over 1 in 4 adults will likely become disabled at some point before they retire.3 What’s more, if you experience a disability during middle age, it may coincide with your peak earning years. When planning for medical costs, many younger people in good health don’t think about unexpected health care expenses because most medical insurance covers accidents and hospital stays. What it usually doesn’t cover is total loss of income. While each employer plan is different, employer disability income insurance typically replaces only up to 65% of base salary, resulting in what’s referred to as an “income gap.†Even if you’re able to cover basic expenses on six-tenths of your income, saving for retirement may have to be put on hold indefinitely. With an increase in health-related conditions that may require extended medical leaves, more people are taking out disability income insurance — 35% of our younger study respondents have a policy outside of what their employers offer.1 First, the bad news: By age 65, you’ll have a 70% chance of needing some form of long-term care (LTC) in the future.5 The good news? LTC continues to evolve to be more flexible and consumer-friendly. Buying an LTC policy in your 50s or even younger may mean lower premiums as well as a greater likelihood of passing health care exams required by most providers. In fact, 1 in 5 members of the younger cohort in our study have already obtained LTC insurance.1 If you’re unsure about investing in an HSA, wondering whether your disability income insurance is sufficient or would like to know more about LTC planning, an advisor can help you weigh the options and explore solutions.Key Points

![]()

Close to 1 in 4 of our study respondents reported they’re investing in an HSA.1 These accounts continue to grow in popularity — in 2017, there was a 22% increase in the number of HSAs over the previous year.2

Close to 1 in 4 of our study respondents reported they’re investing in an HSA.1 These accounts continue to grow in popularity — in 2017, there was a 22% increase in the number of HSAs over the previous year.2![]()

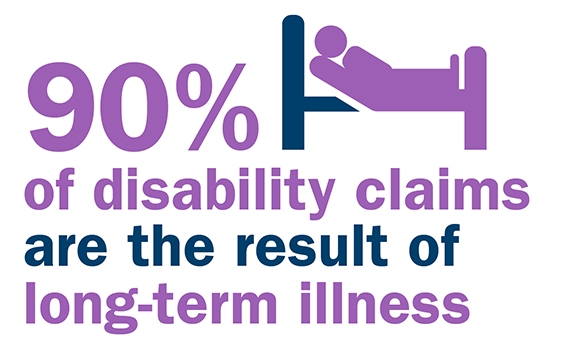

Contrary to popular belief, disability income insurance isn’t just for those in professions involving physical labor. According to RiverSource insurance data, 9 in 10 disability claims are the result of long-term illness, while only 1 in 10 are due to accidents.4

Contrary to popular belief, disability income insurance isn’t just for those in professions involving physical labor. According to RiverSource insurance data, 9 in 10 disability claims are the result of long-term illness, while only 1 in 10 are due to accidents.4![]()

Stand-alone LTC with its “use it or lose it†drawback is becoming a thing of the past, with the advent of a hybrid model that attaches an LTC rider to an individual life insurance policy at an additional cost. If you don’t end up needing LTC, unused funds pass on to heirs via an income-tax-free death benefit.

Stand-alone LTC with its “use it or lose it†drawback is becoming a thing of the past, with the advent of a hybrid model that attaches an LTC rider to an individual life insurance policy at an additional cost. If you don’t end up needing LTC, unused funds pass on to heirs via an income-tax-free death benefit.Talk to us

You may also access this article through our web-site http://www.lokvani.com/