Contribute

| Term Life Insurance: It’s Not So Simple |

Sangita Joshi Rousseau

01/11/2018

Getting Past the Premium to the Real Numbers

A principal attraction of term life insurance is that it offers protection against a premature death at a low initial cost. For those who prioritize accumulation, low cost insurance makes more money available for investment. But when you take a deeper look at the economic factors inherent in term life insurance, you see that an accurate assessment of cost goes beyond simply adding up the premiums.

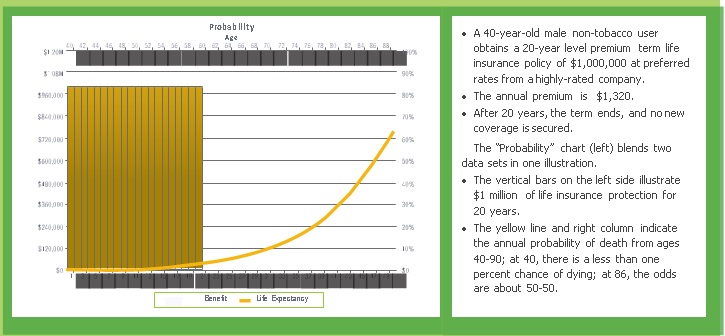

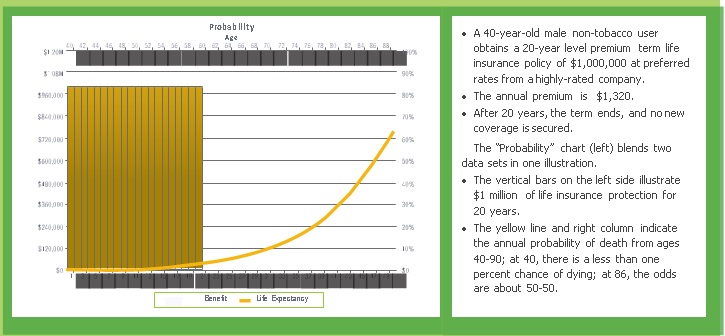

The Living Balance Sheet®*, a proprietary software program for financial professionals, has a module that produces customized projections of the not-so-obvious economic factors associated with a decision to use term life insurance to protect an individual’s economic value. The following illustration and assessment are derived from this hypothetical scenario depicted below:

This is the actuarial element in term insurance: there is a low likelihood that death will occur during the term, which explains “the low initial cost.†After age 60, the probability of dying increases steadily. This clearly reveals why very few term life insurance policies (some experts say less than one percent) result in a claim: most policies are expected to terminate before the insured does.

Adding It Up

In this example, the most likely outcome from a decision to buy term life insurance will be 20 years of premiums paid, no death, and a termination of benefits. Twenty years of premiums adds up to $26,400. But the financial impact is more than the premiums.

Considering the very low probability of a death occurring during the term, it is reasonable to apply an opportunity cost to the premiums – what the money could have been worth if it had not been used to buy life insurance. At an annual time-value-of-money rate of 7 percent, 20 years of premiums result in a cumulative opportunity cost of $31,502 by age 60.

But opportunity costs don’t stop compounding when a policyholder stops paying premiums. The $31,502 keeps accruing until the insured’s death. And someone healthy enough to qualify for a preferred life insurance policy could live a long time. If our healthy non-tobacco user makes it to 90, those premiums will have compounded to a value of $440,865.

The time value of money rate is arbitrary – you could assume more or less – but it makes the “low initial cost†of term insurance look a little more expensive, doesn’t it?

And, while the odds are long that death will occur before age 60, it is an absolute certainty that death will occur. If the coverage had stayed in force, there would have been a $1 million payment to beneficiaries. But, because the policy ends after the 20th year, the death benefit will almost surely be forfeited.

A life insurance death benefit is a financial certainty that enhances or improves the utility of other assets. This financial certainty can be particularly relevant in financial plans where the coverage is designed to be in force for one’s entire lifetime. Surrendering a life insurance death benefit is a loss that should be included in a financial impact assessment. Here is a summary of the Total Financial Impact of this hypothetical decision to buy term life insurance:

Total Premiums: $26,400

Time Value of Money @ 7% (to age 90): $414,365

Lost Death Benefit: $1,000,000

Total Financial Impact: $1,440,765

Is it time for an in-depth look at life insurance?

You may not have evaluated term life insurance beyond the initial premiums. And even though you’ve been shown a different perspective on the financial impact of buying term, it might conflict with the simple view you had before. So…

You could manipulate these numbers by finding a lower premium, assuming death at an earlier age, and using a different time value of money assumption, which would still result in…a total financial impact in excess of $1 million.

You could say, “Yeah, but…†and refuse to accept the logic behind the calculations, even though there are plenty of instances where a life insurance benefit is considered a financial asset.

Or you could say, “Hmm. Maybe there’s more to this than I thought.†And when a financial professional says, “Has anyone ever shown you how you can be the beneficiary of your own life insurance?†you might say, “I’m intrigued. Tell me more.â€

*The Living Balance Sheet® (LBS) and the LBS logo are service marks of The Guardian Life Insurance Company of America (Guardian), New York, NY. © Copyright 2005-2018 Guardian.

You may also access this article through our web-site http://www.lokvani.com/