Archives

Contribute

|

|

Overview Of The MA Legislature's Budget For Fiscal Year 2018

|

|

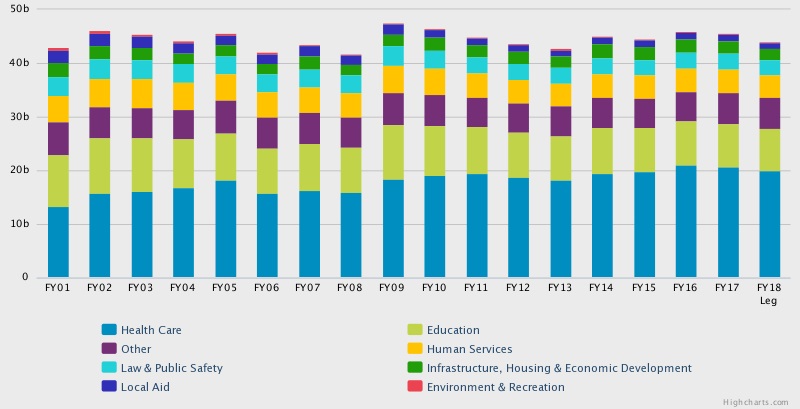

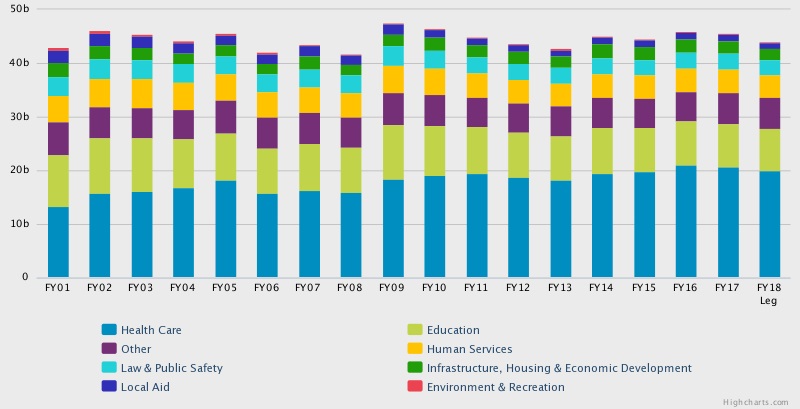

Press Release

07/13/2017

On Friday the Legislature enacted a Fiscal Year 2018 (FY 2018) budget that assumes less revenue will be available than initially projected and accordingly provides less in funding than the budgets approved by both the House and Senate. The state budget is how our government sets funding levels for everything that we pay for through our state government: local services and transportation infrastructure; our schools, colleges, and universities; child care, job training, and other work supports; enforcement of laws that keep our communities safe and our air and water clean; a safety net for when we face hard times; and other basic services that improve the quality of life in our Commonwealth. The Legislature's budget eliminated some modest proposed funding increases (such as the 3 percent increase in higher education funding in the Senate budget) and reduced funding to levels below both the House and Senate proposals in other cases. For instance, disability services receives about $26 million less than the amounts proposed by the House and Senate, although more than FY 2017 funding levels. This budget also relies more on temporary revenue than the original House and Senate budgets. It includes a provision to count as revenue $205 million that the Legislature hopes will be left over in various accounts at the end of FY 2018 (this revenue source is called "reversions" because it is money that would ordinarily revert to the General Fund if not spent on the purposes for which it was appropriated). Recognizing that this budget underfunds a number of accounts, budget writers create a new reserve account that sets aside $104.1 million in contingency funds for several accounts: sheriffs, public defenders, and transportation (the account for paying the cost of removing snow and ice from roads is underfunded). MassBudget's Budget Browser shows the funding levels for each line item and budget category for the budget enacted by the Legislature, along with the proposals by the House and Senate and the Governor. The Budget Browser also provides historic funding levels for each account. MassBudget's Children's Budget provides additional information about each program in the state budget that serves children. After the Governor signs the budget and makes his vetoes, MassBudget will produce a complete Budget Monitor examining each major section of the budget. The bullets below provide a brief summary of significant elements of the budget enacted by the Legislature. - The Legislature's budget provides a modest increase above FY 2017 levels in funding for early education and care, with new funding dedicated to increase the rates paid to providers of care.

- The budget provides a 2.6 percent increase from FY 2017 in Chapter 70 Local Aid for Education. It provides less funding, however, for building schools than was included in the House and Senate budgets because this funding is set at a portion of sales tax receipts and the Conference Committee adopted a lower projection of such receipts.

- The Legislature's higher education budget for FY 2018 comes in at $7.5 million, or 0.6 percent, above FY 2017 levels, which is not enough to keep up with inflation. This is $35.1 million, or 2.9 percent, below the Senate's proposed FY 2018 allocation and $5.2 million, or 0.5 percent, below the House's proposed FY 2018 allocation. While the Senate's higher education budget would have made tuition and fee increases less likely, the Conference Budget, which hews more closely to the House proposal, makes these increases more likely.

- The House had approved $96.6 million in funding for the State Scholarship Program; the Senate $96.9 million. The conference budget comes in below both the House and Senate proposals, at $95.9 million -- 0.2 percent above FY 2017 levels.

Housing: - The Legislature's budget for the Emergency Assistance (EA) shelter program for low-income, homeless families is $155.9 million, which is level with the House's recommendation and $10.2 million below the amount recommended by the Senate. The Senate allocation for this program was expected to meet projected caseload levels for FY 2018. By adopting the lower level in its final budget, it is likely that the Legislature will need to provide supplemental funding for this program over the course of FY 2018.

- The Legislature's budget provides $92.7 million for the Massachusetts Rental Voucher Program (MRVP) rather than the $100 million that both chambers approved in their respective budgets. Both chambers estimated that this higher funding level would have created 300-400 new vouchers for low-income renters. The Legislature's budget also increased the amount of income that low-wage renters can earn before they lose their vouchers.

Human Services: - The Legislature reduced funding below the levels proposed by the House and Senate for many of the line items that help support and stabilize families involved in the state's child welfare system, most notably cutting supports for adoption and foster care services to $568.8 million, over $4 million below the amount proposed by either the House or the Senate. The total for the line items funding caseworker support stayed steady at $240.0 million. This total is $13.6 million, or 6 percent, above FY 2017 funding. There is also language in the budget creating an identification card for caseworkers and protections for caseworkers from being asked to share information such as home addresses or personal telephone numbers while on the job.

- Total funding for disability services, elder services, and juvenile justice programs is below both the House and Senate proposals, but marginally higher than current FY 2017 levels (between 2 to 4 percent). Disability services, in particular, receive the largest decline from House and Senate proposals, $25.6 million and $26.7 million, respectively, due to various cuts across most services.

- For transitional assistance programs, funding is level with House and Senate proposals and 5 percent below FY 2017 levels. The reduction is largely because of anticipated caseload declines.

Law and Public Safety: - The major story in law and public safety is that the Legislature underfunds two significant accounts. This budget provides $44.6 million less in funding for sheriffs than the state expects it will need and $45.9 million less for Private Counsel Compensation (PCC) than will likely be needed. As noted in the introduction, the Legislature has included a reserve account of $104.1 million that could be used to supplement funding for, among other items, the sheriffs and PCC accounts.

Mental Health: - The Legislature's budget reduced several line items within the Department of Mental Health below levels proposed by the House or the Senate. For example, adult mental health receives $387.1 million, $1.3 million less than the House or Senate proposals.

- Child and adolescent services, receive $91.7 million including expanded case management services for young adults, and $3.7 million for the Massachusetts Child Psychiatry Access Project (MCPAP). This funding also includes the MCPAP for Moms program to screen for postpartum depression and directs MCPAP to report on care coordination and on recommendations for expanding the reach of the program.

MassHealth: - The Legislature's FY 2018 MassHealth budget includes $16.20 billion for the MassHealth program, $260.1 million below the Senate, and $311.7 million below the House. Most notably, the Fee-for-Service line items are $241.7 million below the Senate, and $267.6 million below the House. The Legislature states that the program will see $150 million (presumably net of reduced federal reimbursements) in savings under this budget, "...related to caseload, program integrity and other efficiencies." These efforts would likely include maximizing the use of the MassHealth Premium Assistance Program when it is in the financial interest of the state to do so, and also enacting stricter requirements for enrollment and redetermination procedures.

- Although the Governor had proposed a variety of MassHealth reforms towards the end of the Conference Committee deliberation process, the Legislature did not include them in the budget proposal. These reforms would have involved new federal Medicaid waiver changes, changes to eligibility and benefits, and reforms to the commercial health insurance market.

- The Legislature included language that creates a new two-tiered Employer Medical Assistance Contribution (EMAC). This budget increases the EMAC by $26 per employee and assesses a $750 fee for each employee receiving publicly-subsidized health care either through MassHealth or through ConnectorCare. This proposal would generate $200 million in revenue. At the same time, the Legislature proposes changing the unemployment insurance schedule, which would allow employers to pay $334 million less than under the current schedule.

Transportation: - The Legislature reduces funding to the Massachusetts Transportation Trust Fund (MTTF) by $39.7 million compared to the FY 2017 budget. But, for the most part, this will likely not turn out to be a cut. The Legislature appears to be significantly underfunding the account for potential snow and ice removal costs. This reduction is likely to be largely offset by the Legislature's new contingency fund created for underfunded accounts.

- The Legislature's budget reduces funding for the state's 15 Regional Transit Authorities (RTAs) to $80.4 million in FY 2018, which is below the House and Senate recommendations and the $82.0 million the RTAs received in both FY 2017 and FY 2016.

|

|

You may also access this article through our web-site http://www.lokvani.com/

|

|