The cost of special business tax breaks continues to grow. Today we're releasing an update to last year's report, "

The Growing Cost of Special Business Tax Break Spending."

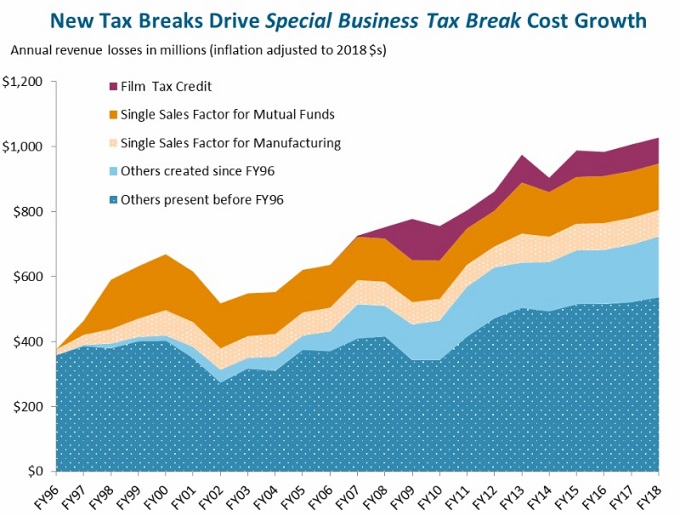

Based on new and updated estimates from the administration, the paper

shows that the Commonwealth's annual spending on business tax breaks

aimed at supporting economic development in Massachusetts continues to

rise. These costs are expected to exceed $1 billion for the first time

this 2017 fiscal year, and the Department of Revenue projects them to

growth further in Fiscal Year 2018.

Although often not subject to the regular and close scrutiny

given to on-budget programs, spending on these tax breaks is no

different in its bottom-line effect than direct spending through the

state budget; each limits the resources available for other state

priorities. Adjusting for inflation, these costs have increased from

$370 million in Fiscal Year 1996 to $1.028 billion projected in Fiscal

Year 2018.

Last week the Pew Charitable Trusts released a national

report

ranking the fifty states on how well they evaluate their spending on

economic development tax incentives. Massachusetts was ranked in the

lowest tier, along with 22 other "trailing" states. The report noted

that, "Massachusetts is trailing other states because it has not adopted

a plan for regular evaluation of tax incentives."

You can read MassBudget's updated analysis of special business tax break spending here (

LINK).