Contribute

| The Wealthy Are Different: They Own Life Insurance |

Sangita Joshi Rousseau

03/02/2017

Imitation may be the sincerest form of flattery and often a template for those who aspire to achieve the same status. If you want to be an ultra-marathoner, you train like one. If you want to be wealthy, you consider how to emulate their behaviors and habits. You may decide to become an expert in your field, start a business, or copy their asset management strategies. And you might want to own life insurance. Owning life insurance does not guarantee wealthy status any more than simply starting a business does. But among the characteristics that appear to correlate with the thought processes and values of wealthier American households, life insurance ownership is prominent for its contrast, especially compared to previous generations.

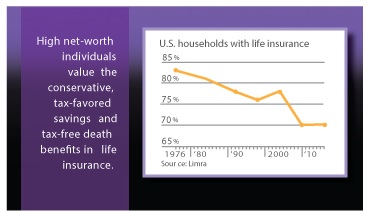

A January 12, 2017, Wall Street Journal article, “The Latest Gamble in Life Insurance: Sell It Online,” highlights a four-decade decline in life insurance ownership by American households, as well as a technology-driven attempt to reverse the trend. The graph here, provided by the Life Insurance Marketing and Research Association (LIMRA), shows that sales of individual life insurance policies have declined more than 40% since the 1980s. Today, 30% of U.S. households have no life insurance at all – not even group coverage. This compares to 19% who were without life insurance in the earlier period.

Industry observers attribute the long-term slide in life insurance ownership to social and industry changes over the past 40 years, including two-income households, the proliferation of other saving/investing options, and the Internet. For almost one in three Americans, it appears life insurance is no longer a financial essential.

To address this decline, some insurers are moving the entire application process online. Instead of requiring blood samples, urine tests, and medical records, underwriters are relying on algorithms derived from answers to online applications, combined with data pulled (with the applicant’s consent) from prescription-drug databases, motor-vehicle records and other sources. The goal is to deliver a quick underwriting decision – usually within one day, and sometimes as quick as 30 minutes.

Most of the policies currently offered through online channels are term insurance in amounts under $1 million, and are targeted to younger, less-affluent (at least right now) consumers. This strategy is prompted by several factors:

• The decline in individual life insurance protection is strongly correlated to a decrease in life insurance among the middle class. This is an under-served market.

• Term policies are the simplest to explain and understand in an online format, one that doesn’t require the assistance of a financial professional. Life insurance can be a D-I-Y project.

Proponents of the process believe that this blend of technology and convenience “may transform the business.” And it might. But a closer look at life insurance ownership suggests other factors are involved.

Different Values for the Same Product

The decline in life insurance ownership is sort of misleading, because other industry data indicate life insurance remains a viable and valuable financial instrument. In fact, many insurance companies have reported increasing and record sales in the past decade. It’s more accurate to say more life insurance is in force, yet owned by fewer Americans.

This paradoxical growth and decline of life insurance ownership among American households is more likely connected to diverging financial philosophies; different segments of the population see life insurance differently.

The primary appeal of many, if not most, financial products marketed to the middle class for long-term accumulation is the potential for higher returns. This emphasis tends to obscure or ignore the conservative, multi-faceted, and integrative benefits of life insurance. In the higher-return paradigm, life insurance has a very narrow application: savers will “need” it for a limited time, and only for the specific purpose of replacing income. The goal is to own as little life insurance as possible, for the shortest period, at the lowest premium.

Contrast this perspective with the reasons wealthier individuals choose to own life insurance. In a September 2014 article in the Insurance Innovation Reporter, Ken Hittel, a former insurance executive with more than two decades of experience in the industry, notes that life insurance “turns out to be an especially attractive product to (affluent clients), one they are eager to buy for its 1) tax free death benefits and 2) tax free “inside” (investment) “build-up.” Hittel bolsters this claim with the following statistics regarding ownership of the tax-deferred inside build-up, i.e., life insurance cash values:

6.5% of life insurance cash values…are held by American households with a net worth in the bottom 50 percent of the population.

38.5% of life insurance cash values…are held by those in the 51st - 90th percentile.

55.1% of life insurance cash values…are held by the top 10 percent of net worth individuals.

(Note: Because of rounding, the total is slightly more than 100%.)

These numbers mirror other financial metrics where a high percentage of assets or income are controlled by smaller, wealthier segments of the population. They suggest high net-worth individuals value the conservative, tax-favored savings in life insurance, and the tax-free death benefits that will eventually be distributed to their beneficiaries. This perspective is a sharp contrast to the “middle-class” life insurance mantra of little, brief and cheap. And the difference prompts some additional observations:

• If life insurance is purely a “need” product, ownership statistics say the wealthy need life insurance more than the middle class. Yet by the very nature of their higher incomes and greater wealth, the top percentiles would seem to be much better equipped to withstand financial loss, with or without life insurance.

• If pursuing higher returns is a superior strategy, the wealthy – while having more money – must be financially “dumber” than their middle-class counterparts by electing to own, and intending to keep, life insurance.

-- Mainstream financial experts are telling the middle-class that “smart money” doesn’t put it in life insurance. Except it does. And this knowledge may prompt some reflection by those who aspire to a more prosperous financial life, on which approach to emulate.

You may also access this article through our web-site http://www.lokvani.com/