Contribute

| Retirement Spending: The Difference Between Theory & Practice |

Sangita Joshi Rousseau

09/08/2016

Among his many memorable quotes, Hall of Fame baseball player Yogi Berra once said, “In theory there is no difference between theory and practice. In practice there is.â€

If he hadn’t made it in baseball, Yogi could have been a fine behavioral economist. Berra’s quote neatly summarizes a recent finding that many current retirees have a “retirement consumption gap,†which means their actual spending is less than their available spending. What’s more, the study found the consumption gap is greatest for those have accumulated the most.

“Spending in Retirement: The Consumption Gap,†a February 2016 report by four Texas Tech professors started with the assumption that “retirees draw down their wealth in order to fund retirement spending. The economic rationale is that people save money during their working years so that they can eventually spend it.†This assumption reflects a prevailing paradigm for retirement income planning; the objective is to develop strategies and withdrawal sequences to provide maximum spending potential from a retiree’s savings.

But the Texas Tech report found, “(R)etirees seem to spend much less than theory would predict. Rather than spending down savings during retirement, many studies have found that the value of retirees’ financial assets hold steady or even increase over time.â€

The consumption gaps even affect required minimum distributions (RMD) from qualified retirement plans; retirees take distributions only to reinvest them. Even when accounting for a desire to leave an inheritance and thus reduce spendable assets, the authors calculated the wealthiest 20 percent of retirees had consumption gaps of over 40 percent, i.e., they could safely spend 40 percent more each year.

Why such a large difference between theory and practice? A combination of mathematical and psychological factors seems to be at work. Calculating a Safe Withdrawal Rate As more workers enter retirement without a pension, they face the challenge of finding safe and effective ways to turn existing accumulations into a stream of retirement income.

In 1994, financial advisor William Bengen first articulated a 4% withdrawal rate as a yardstick for delivering a consistent retirement income with minimal risk of running out of money. Bengen’s historical research showed that retirees who drew down no more than 4.2 percent of their portfolio in the initial year, and adjusted that amount each year for inflation, had a great chance their money would outlive them. In the ensuing two decades, there have been more sophisticated iterations of Bengen’s idea, but every projection of a safe withdrawal rate includes the following four items:

â–º A lump-sum for producing retirement income, both through earnings and drawdown of principal.

â–º A first-year income that serves as a baseline for future withdrawals.

â–º An assumed average annual rate of return.

â–º An assumed average annual inflation rate.

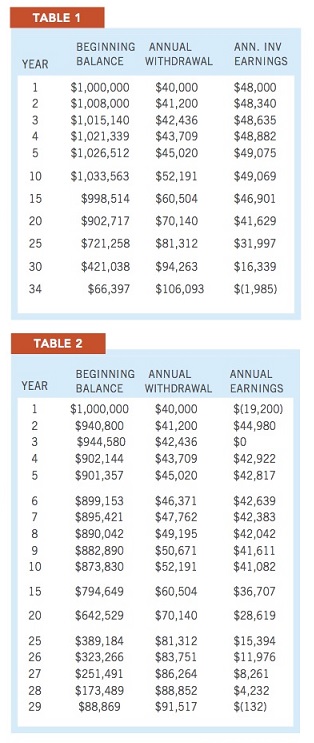

Here’s a simple retirement income withdrawal scenario using these ingredients (see Table 1):

• A 65-year-old retiree has $1 million in retirement assets.

• The first-year retirement income withdrawal will be $40,000, equal to 4% of the beginning balance.

• Each year, the amount withdrawn will increase by 3%, reflecting the assumed average annual rate of inflation.

• A 5% average annual rate of return on the lump sum is assumed, compounded annually.

The plan doesn’t run out of money until the 34th year, when the retiree would be 99 (and receiving an annual income over $100,000). Superficially, this projection validates Bengen’s 4% rule. However, a closer look reveals some interesting mathematical quirks, and those quirks matter.

Even though withdrawals increase annually, the retiree’s accumulation balance continues to grow for nine years, and doesn’t drop below $1 million until the 15th year. This is because most spend down projections require the account balance to grow, at least a little, in the early years of retirement to cover the inflation-adjusted income needs later on. Therefore, the assumed annual rate of return must exceed the initial withdrawal rate (in this example, average annual returns must be greater than 4 percent).

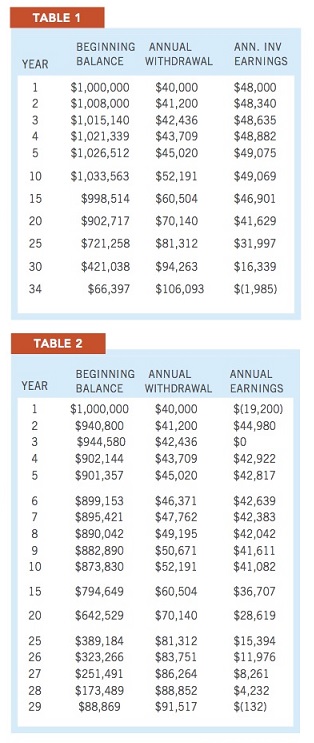

There’s another twist: even if the average annual rate of return exceeds the withdrawal rate, this model only works if retirees experience positive investment returns in the early years of retirement. If they don’t, the inflation-adjusted withdrawals devour the accumulation in a hurry. To illustrate: Take all of the assumptions from the first projection, except for two years – the first, where the portfolio loses 2%, and Year 3, with a zero return. From Year 4 on, returns stay at 5% annually. Look at the difference in Table 2.

The money will still last for 29 years, to age 94, which should be sufficient for most life expectancies. But note that the account balance drops below $1 Million the first year, and except for a $4,000 increase in Year 2, keeps falling.

The above examples are very crude projections. More sophisticated spend-down calculators can process multiple return periods to generate best- and worst-case scenarios, and the probabilities for variance from historical averages. But when just two years of minimal losses in a simple illustration have this kind of long-term impact, and recognizing that actual inflation and return rates will be anything but stable, it’s easy to see that retirees might feel a bit uneasy about spending down principal, even if the math tells them they can. This would seem particularly true for a retiree who experiences lower-than-expected returns at the beginning, and sees the balance decline right away.

The Consumption Gap Exists Because There is No Insurance

The difference between safe withdrawal rate theory and retirement consumption gap practices is probably due to a lack of financial certainty. With no lifetime guarantees like those provided by a pension or annuity, many retirees seem to intuitively recognize their management limitations. The Texas Tech professors concluded “It appears, in the absence of annuitized wealth, retirees have little confidence in their ability to decumulate effectively.â€

Yet retirement advisor Michael Kitces doesn’t think the problem is a lack of confidence on the part of retirees. Per a July 6, 2016, blog post, Kitces feels that a reluctance to draw down principal “isn’t a sign of inefficient portfolio spending or a consumption gap, but merely the prudent reality of dealing with an uncertain future!†When you don’t have financial guarantees, you have to be more cautious. Or you have to consider adding some insurance into your retirement income plan.

Can Guarantees Close the Consumption Gap?*

While detailed math formulas may indicate retirees can probably spend more, a probable outcome is not the same as a guaranteed one. When some income is guaranteed – regardless of market conditions, inflation or personal circumstance – other assets can be spent more freely. This is the purpose of annuities, which are insurance contracts to guarantee a lifetime income. And the guaranteed death benefits from permanent life insurance policies can be used as a “permission slip†to spend other assets, knowing this end-of-life financial payment is waiting.

You may also access this article through our web-site http://www.lokvani.com/