Contribute

| Deepti KC And Mudita Tiwari Use Comic To Help Make Better Financial Decisions |

Press Release

04/28/2016

It is said that a picture is worth a thousand words, and better still, a cartoon, which can offer a more comprehensive understanding of complicated topics. Keeping that in mind, two Indian American researchers with the Institute for Money, Technology and Financial Inclusion, housed within the University of California, Irvine — Deepti KC and Mudita Tiwari — have used the power of the visual medium to educate Indian women entrepreneurs from low-income communities to make better financial choices.

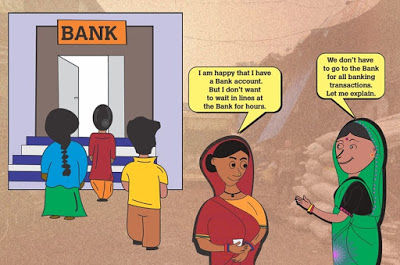

According to their research report, they designed context-specific financial literacy modules that aimed not only at addressing the lack of knowledge about financial products and services, but also the underlying behavioral biases impacting financial decisions. They then developed the modules into a series of comic books using a story telling approach.

KC and Tiwari worked with Creative Rats, a Vadodara, Gujarat-based design and illustration company, to tell the stories of two relatable characters: Saraswati, a vegetable vendor, and Radha, who makes papad (thin wafers) for a factory. Both are neighbors and live in the urban slums of a big city.

The comic books featured eight illustrated tales documenting the financial adversities – mirroring real life problems – that the female characters face and how they resolve financial crisis through better financial management and modifying behaviors.

The topics covered were: Importance of saving; how to prepare the budget; issues with cash on hand; risk of saving with informal institutions; power of compound interest; opening of bank accounts; banking services; and engagement in self-help groups.

Each story ended with a question-answer section and a review about the lessons learnt from the story.

Tiwari and KC found that women who increased their financial literacy with the comics increased their savings 8 percent, while those who did not read the comics increased it by 1 percent.

Funded by IMTFI (University of California, Irvine), IFMR LEAD (Institute for Financial Management and Research, Chennai) conducted a study in Dharavi, Mumbai – Asia’s largest urban slum. The research was aimed at understanding the social, cultural and economic factors influencing modes of payments (cash versus electronic) used by small scale entrepreneurs.

KC has a bachelor’s degree in civil and environmental engineering from the National Institute of Technology-Jaipur and has a master’s degree in environmental and public health engineering. She also has a master’s degree in fundraising management and nonprofit administration from Columbia University. She currently works as a consultant at IFMR and is involved in carrying out several research projects relating to financial inclusion.

Tiwari holds a master’s in public policy and a master's in public health (Epidemiology/Biostatics) from the University of California, Berkeley, and a B.B.A in information technology from Cleveland State University. At the Center of Microfinance (IFMR), she worked on research evaluating the impact of microfinance, financial inclusion, financial literacy programs, and agricultural financing programs in the states of Uttar Pradesh, Bihar, Maharashtra, Punjab, Tamil Nadu, and West Bengal.

You may also access this article through our web-site http://www.lokvani.com/