Contribute

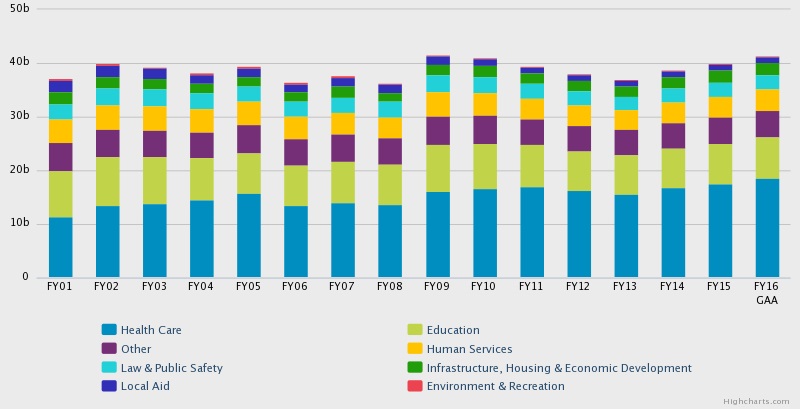

| Analyzing The MA State Budget For FY 2016 |

Press Release

08/20/2015

Analyzing the State Budget for FY 2016

With the House and Senate having overridden a number of the

Governor's vetoes, the Fiscal Year 2016 (FY 2016) budget is now largely

complete. This year's budget makes few major changes in overall funding

provided to educate our children, keep our communities safe, protect our

most vulnerable, strengthen our economy and improve the quality of life

in our communities. Click HERE for our full analysis.

The budget does include several significant new initiatives, including:

- Increasing the value of the state earned income tax credit from 15% of the federal credit to 23%. This will provide additional income to over 400,000 lower wage workers and their families (click HERE for town-by-town detail). Besides improving lives now by helping parents to pay for necessities like food and clothing for their children, this additional support is also likely to expand opportunity for these children over the long run: there is growing evidence that when the income of a lower income family increases, the children often do better in school and earn more as adults.

- Providing significant new tools for the administration to improve management at the MBTA. The budget creates a new MBTA Control Board and authorizes the Secretary of Transportation to appoint the Director of the MBTA. The budget also suspends for three years the Taxpayer Protection Act (commonly called the Pacheco Law) that regulates privatization. The law requires that privatization efforts achieve savings by efficiency improvements rather than by reducing pay and benefits for workers (click HERE for more detail).

- Addressing substance abuse with targeted investments throughout MassHealth, public health and mental health. In particular, new initiatives support first responders and others in the community struggling to address the challenge of opioid addiction.

The final budget, like the budget proposed by the governor back in

March, relies heavily on temporary strategies to balance the budget. It

spends $300 million in capital gains tax revenue that would have gone

into the Rainy Day Fund under current law. It also counts on $100

million from a tax amnesty and $116 million from putting off paying some

of our FY 2016 MassHealth bills into FY 2017.

As has been the case for many years, state budget choices are being

shaped by fiscal challenges that date back to the late 1990s: after

cutting the income tax by over $3 billion dollars between 1998 and 2002

our state has had to make deep cuts in areas like higher education,

local aid, and public health. Meanwhile, the highest income residents in

the Commonwealth are paying a substantially smaller share of their

income in state and local taxes than do the other 99%. If our tax system

were reformed so that the highest income 1% of taxpayers paid roughly

the same share of their income in taxes as everyone else, that would

raise about $2 billion that could be invested in things like making

college affordable, improving our transportation systems, and providing

all children with the supports they need to thrive.

You may also access this article through our web-site http://www.lokvani.com/